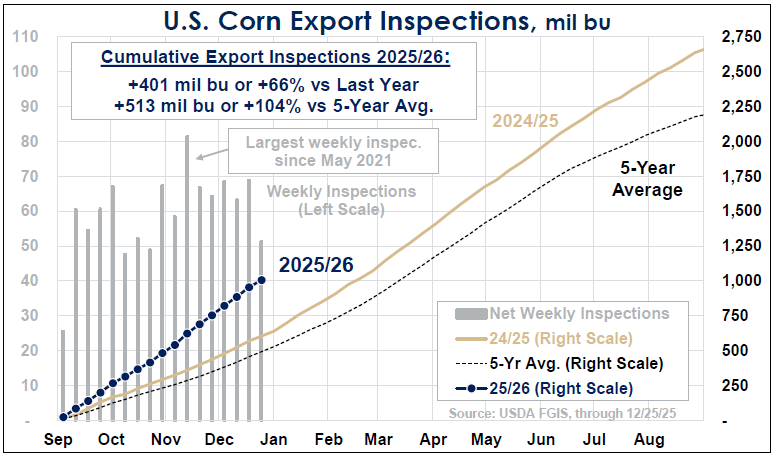

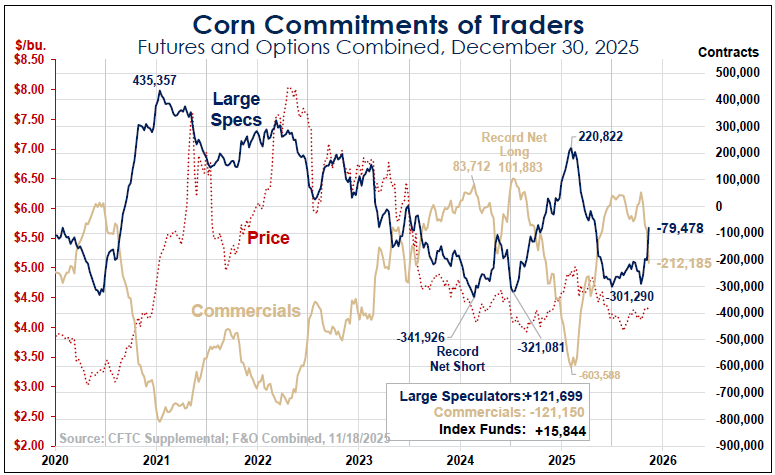

Prices finished the year in very choppy trading action, essentially drifting sideways from September through December. But they did so making higher highs and lows, maintaining their upward trend. The market shifted from a several year long supply-driven bear market to a demand-driven bull market—who knows how long it might last. But the balance sheets are looking much better than they were a year ago.

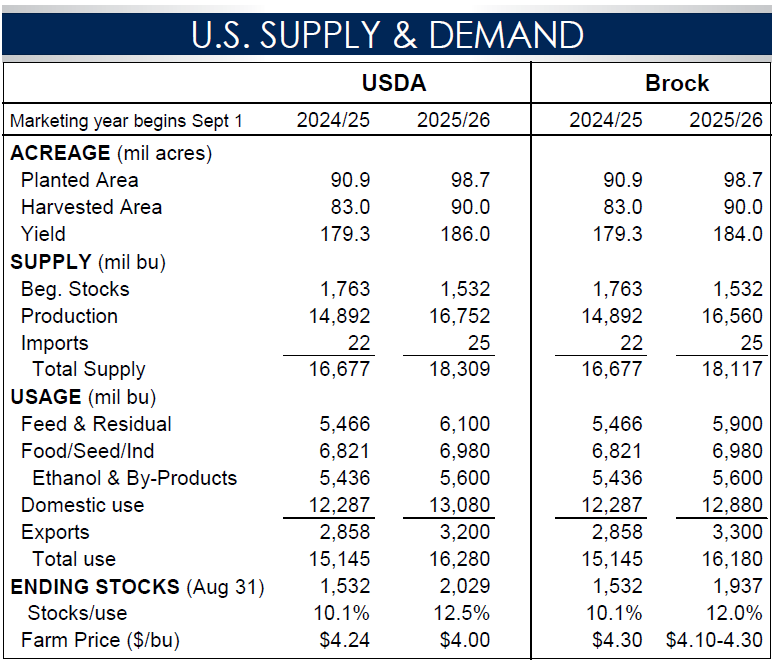

While we are expecting an increase in planted corn acres (see lead story) strong demand both domestically and on the export side are thus far offsetting the increases in supply. This certainly is not an indication that a major bull market is on the horizon, but it is an indication that the downward slide in prices that started in 2022 is now over. Whether this turns into a bull market depends on continued strong demand, and how many corn acres are planted this spring.

Surprises in the balance sheet over the next couple of months, we believe, will likely come on the positive side. Now that it looks clear, the lows are in and the downtrend is over, buyers are taking advantage of the current low prices. These are difficult markets to trade because demand driven bull markets move much slower than supply driven bull or bear markets. Corn is also feeling price pressure from the soybean complex as well as wheat. Neither are much help for higher prices.

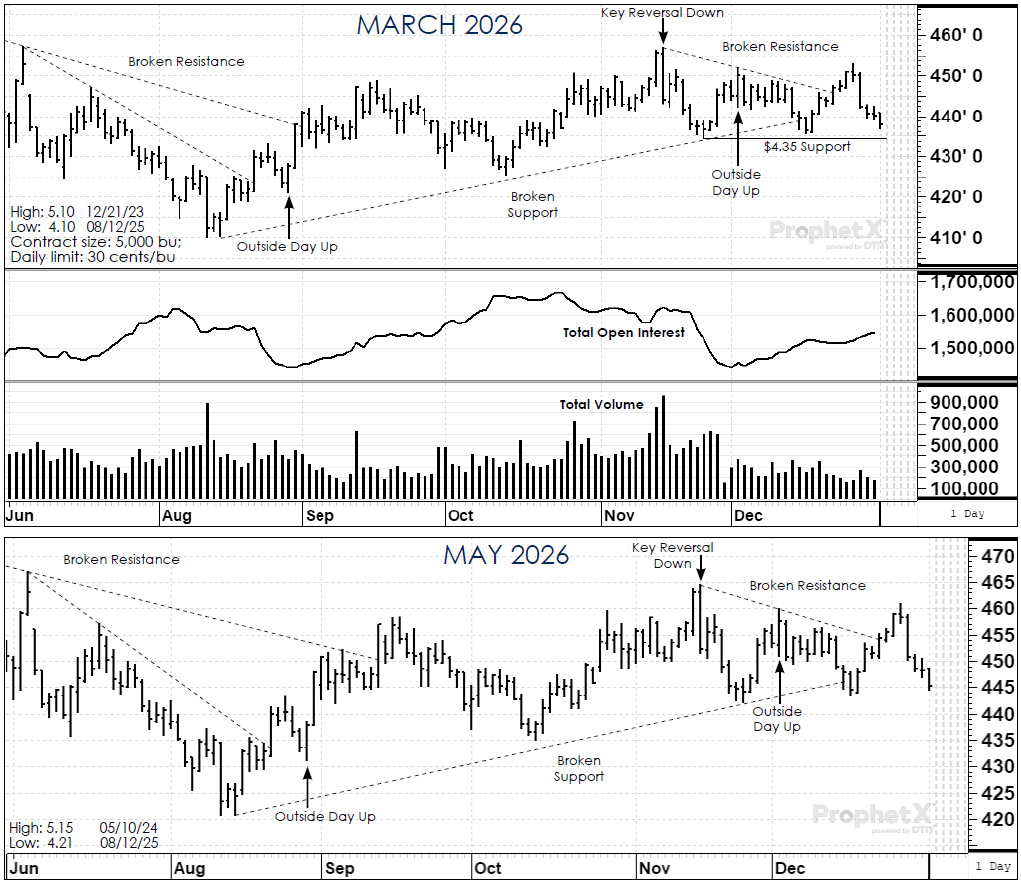

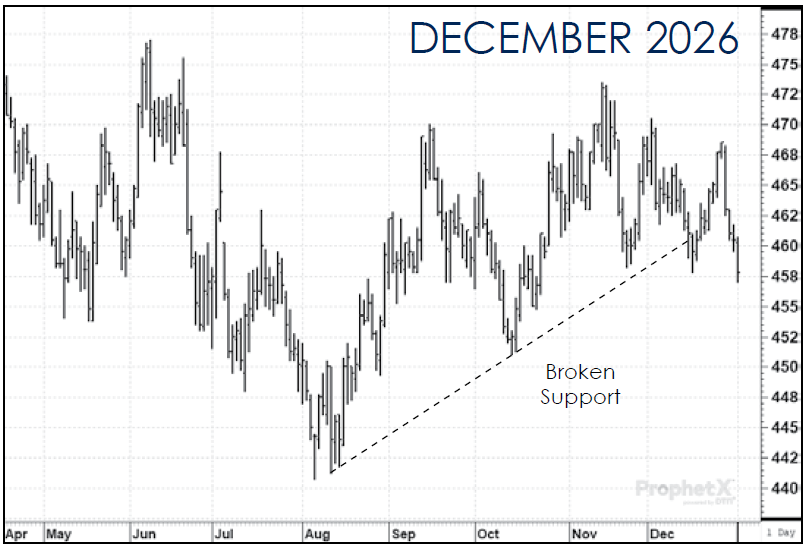

Technically, the trend in corn is still up, but it is testing major support areas which could result in a turn to the downside soon. We are not anticipating that to happen. Near-term support in the March corn futures is at $4.35 while resistance is at $4.50-$4.55. For the early part of 2026, we anticipate the market staying in that range.

Basis levels have also remained firm. Levels are much stronger in the eastern Corn Belt than in the central Corn Belt but, for this time of year, basis levels are better than normal.

We will likely be advancing sales if March futures return to the $4.50 area and likely establish defensive hedges if they break through $4.35. We expect the former to happen before the latter.

Cash-only Marketers’ Strategy: We still want to sit tight. This is a hard market to be patient in. But with the current set of fundamental and technical indicators, there is no reason to be making any major moves. Thirty-five percent of this year’s crop is sold. Nothing for next year.

Hedgers’ Strategy: Thirty percent has been sold in the cash market. No futures or options positions are recommended at this time.