After ending last week on a sour note, lean hog futures rebounded sharply during this holiday-shortened trading week on support from continued seasonal strength in cash hog and wholesale pork prices. The October and more deferred futures all rose to new contract highs this week, while Aug. futures challenged their high on Friday and appear set to move higher.

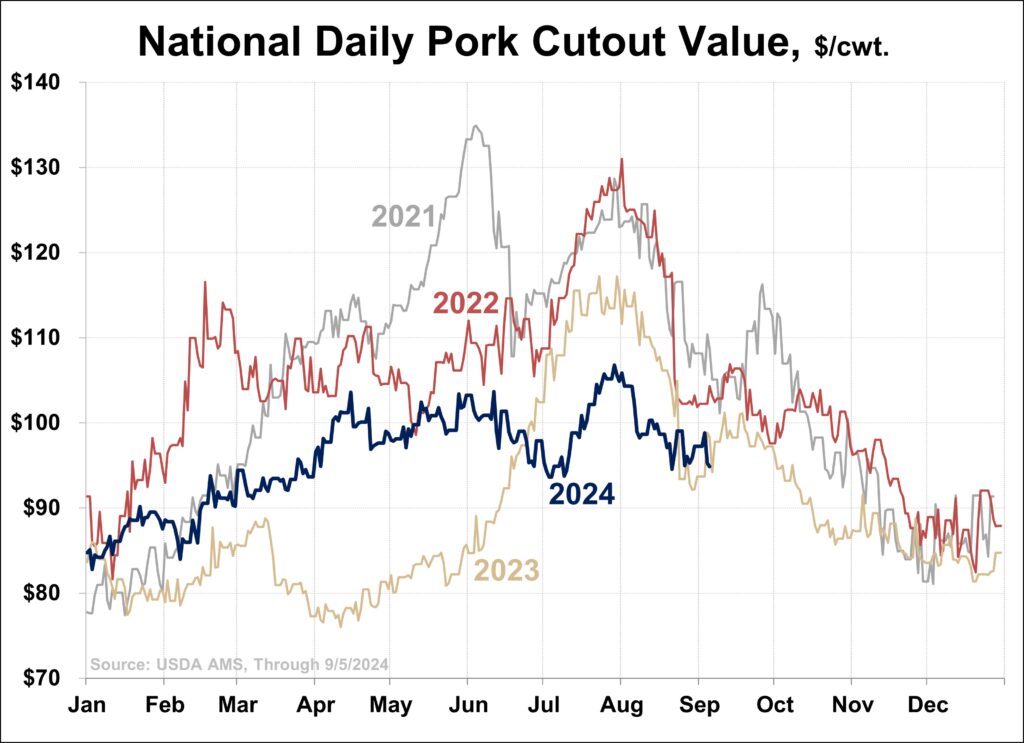

We expect to see further strength in both hog and pork prices in the near-term, although we are now into the timeframe when the annual cash market high is normally made. The CME cash lean hog index rose another $1.38 this week to $94.13, its highest level since August 2023 and is set to move higher next week.

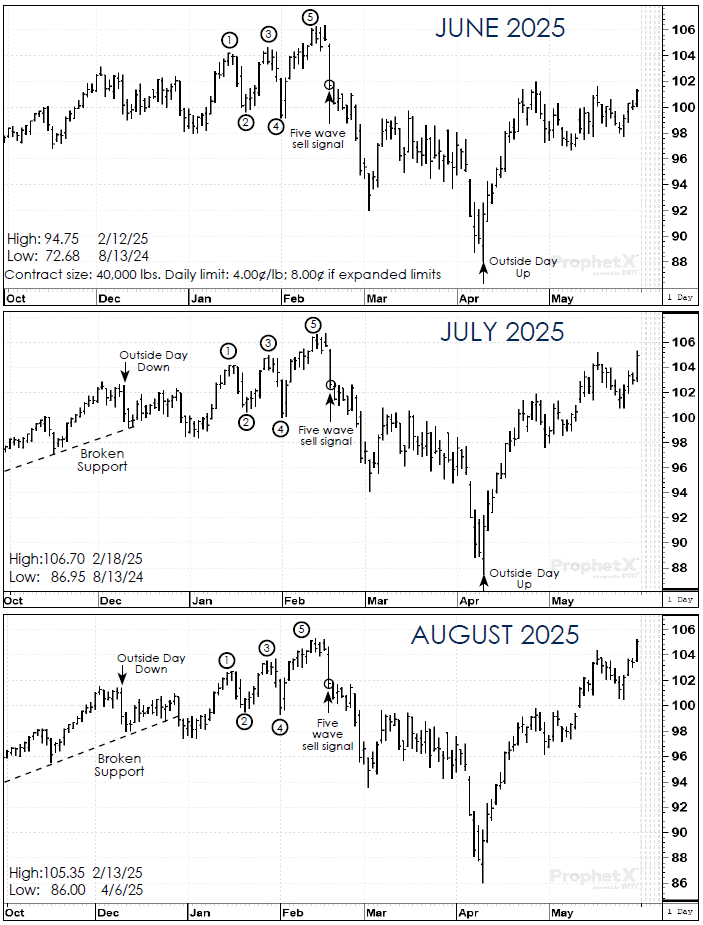

This week’s futures strength forced us out of our Q4 hedge in Dec. futures but, unfortunately, we were not stopped out of our Q3 hedge in Aug. futures. Odds are good we will have to exit that hedge next week. Aug. futures traded within 5 cents of their contract high on Friday and posted a new high close at $105.03. Technically, if the gap on the August chart at $98.38-$98.85 is a measuring gap, the market has a gap objective of $113.25, however, that is a long way away and the market is already about $11 premium to cash.

U.S. pork production for 2025 to date is running 1.7% below a year earlier, along with surging beef prices. Wholesale pork prices jumped higher this week suggesting strong Memorial Day weekend retail clearance. The composite pork cutout value rose $4.35 in the week ended Thursday to the highest level since late July 2024 and was up sharply on Friday morning on a jump in pork belly prices. Last Friday’s monthly USDA Cold Storage report showed U.S. frozen pork stocks as of April 30 were up 11% from the end of March, but were still down 8.7% from a year earlier.

Hedgers’ Strategy: Hedgers remain short Aug. 2025 lean hog futures against 50% of Q3 marketings but exited a short position in Oct. futures against 50% of Q4 marketings on Wednesday.