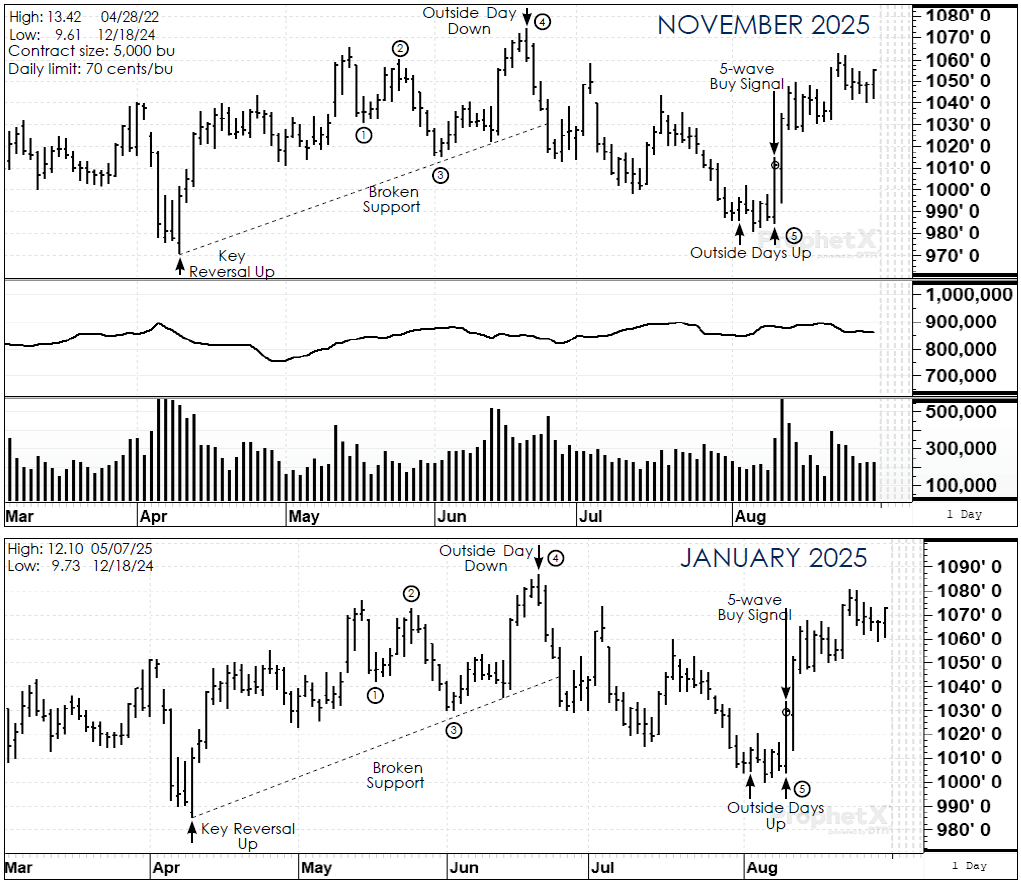

Technical signals in the soybean complex are mixed. The trend remains up. Nearby futures appear to be making a pennant formation which would infer another leg up in prices. At the same time, the market has rallied 70 cents from its lows and offers an opportunity for catch-up sales.

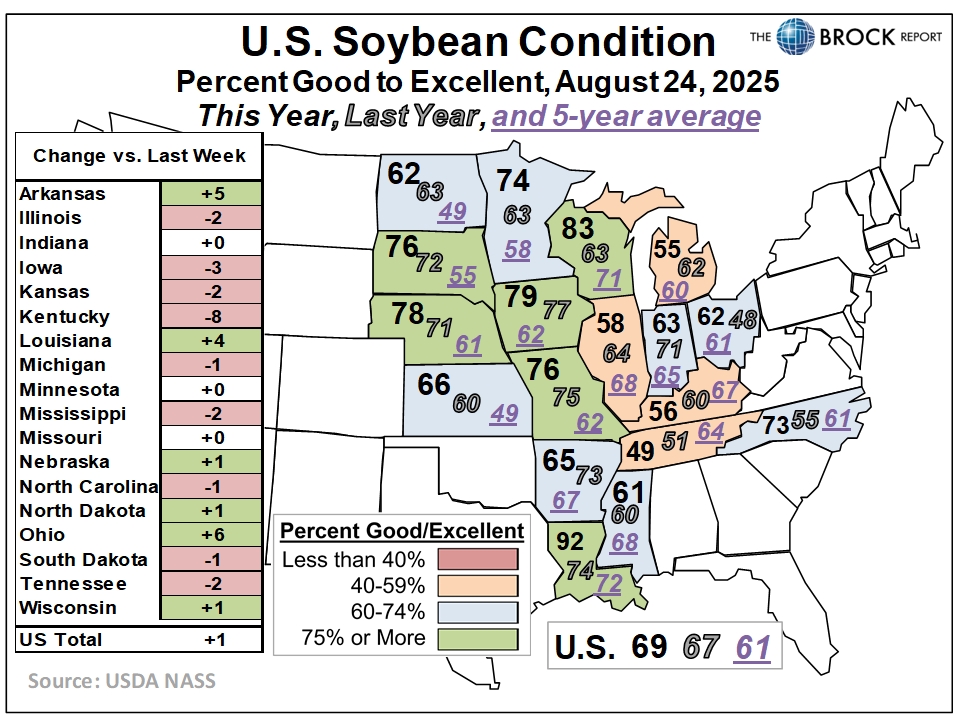

Early soybean yields in the Mississippi Delta are coming in on the strong side. Harvest in the southern Corn Belt will start soon but as of now almost no yields are being reported. This is one area of concern due to dryness across the northern Delta and into the Ohio Valley.

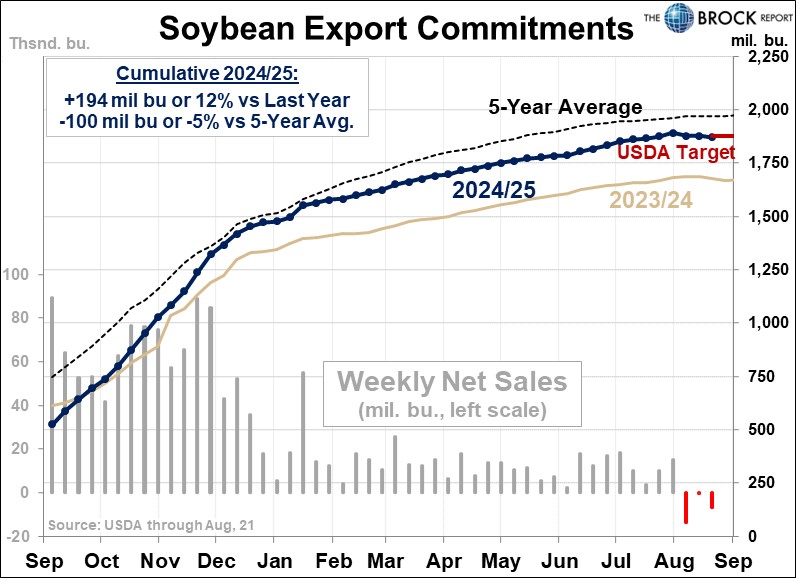

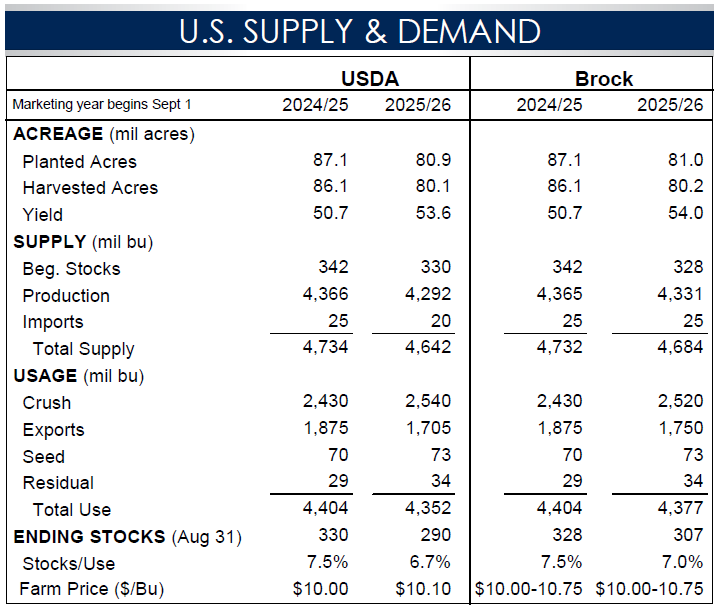

Exports have been holding up relatively well, but China’s absence from the U.S. soybean market remains very conspicuous. New-crop export sales were good for the second straight week on Thursday, and the weekly total was the highest so far, but total new-crop sales of 265.6 million bushels to date through Aug. 21 were still 28.9% below a year earlier. China’s buying is focused on South America, and even if we do end up with a trade deal — and there’s no sign of that happening soon — domestic demand for renewable diesel production is going to have to do much of the heavy lifting for the market in the year ahead.

Technically, the major support area in November beans is at $10.30 and the resistance is at $10.60. Harvest pressure will likely keep soybean prices in that range until harvest is near complete.

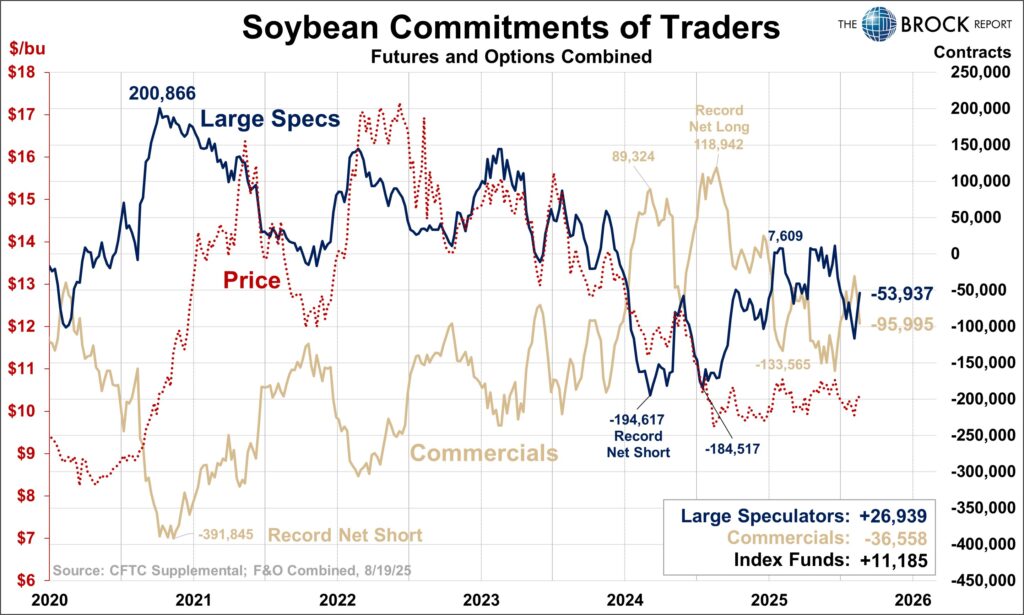

Also note that in the last week, open interest has dropped off fairly significantly. That is an indication that long positions are starting to exit the market. In order to go higher, the market desperately needs a new round of purchasing. The bottom line: This market is likely to stay in a choppy sideways trading range for the next couple of weeks.

Cash only marketers’ strategy: Thirty percent is forward contracted. If you’re not at that level, use this price strength to catch up.

Hedgers’ strategy: Same cash advice as above. All short futures hedge profits have been put in the bank.