Over the last 20 years changes in corn and soybean production and exports throughout the world are like the old story of boiling a frog in water. Everybody knows that one. It’s happened gradually and very few people have been paying close attention to it. This week China, as is the case almost every week, was in the news again but for different reasons. In the provinces of Henan and Shandong, which represents 20% of China’s grain output, the area has just received the heaviest rains in 60 years. It is having a significant impact on harvest and in some cases cutting yields dramatically because of field conditions. Meanwhile, China’s corn imports this year are down 93% compared to a year ago.

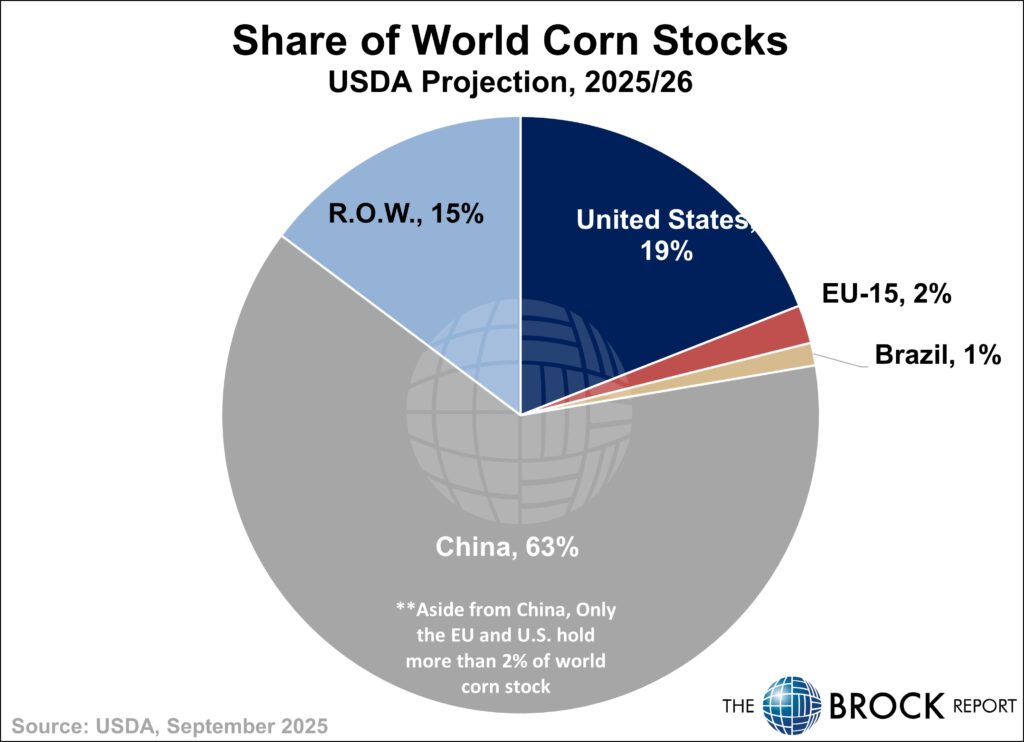

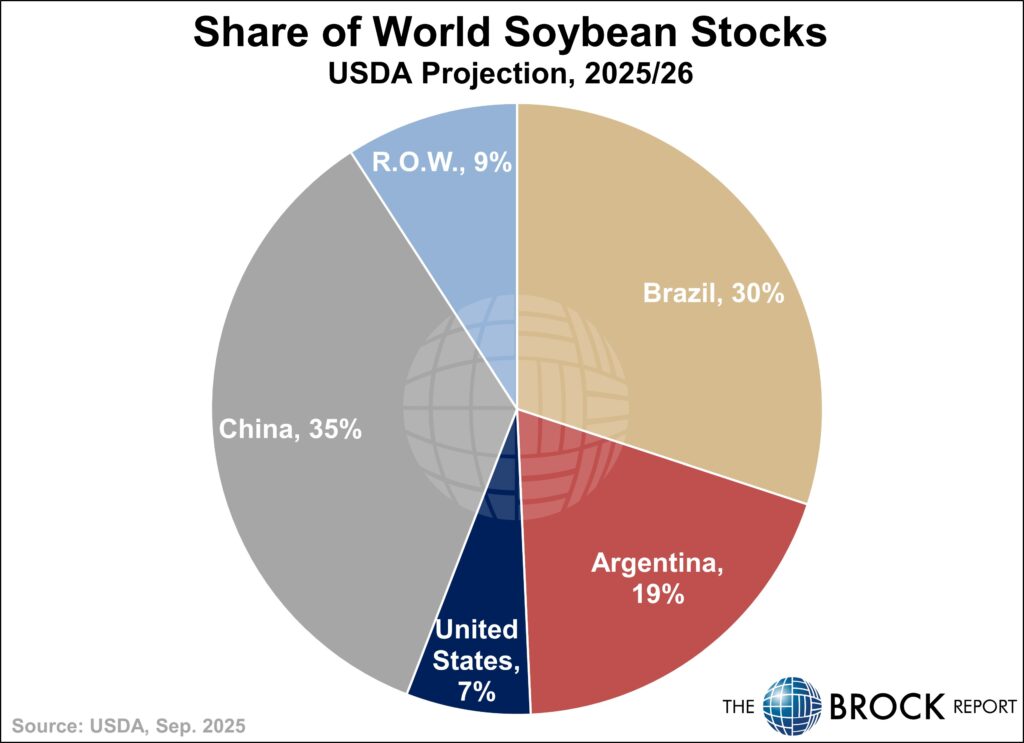

The graphs below tell a compelling story. As of now, China holds 63% of the world corn supply. They hold 35% of the world’s soybean stocks. Brazil now represents 60% of the world’s soybean exports and has also captured a significant share of world’s corn exports.

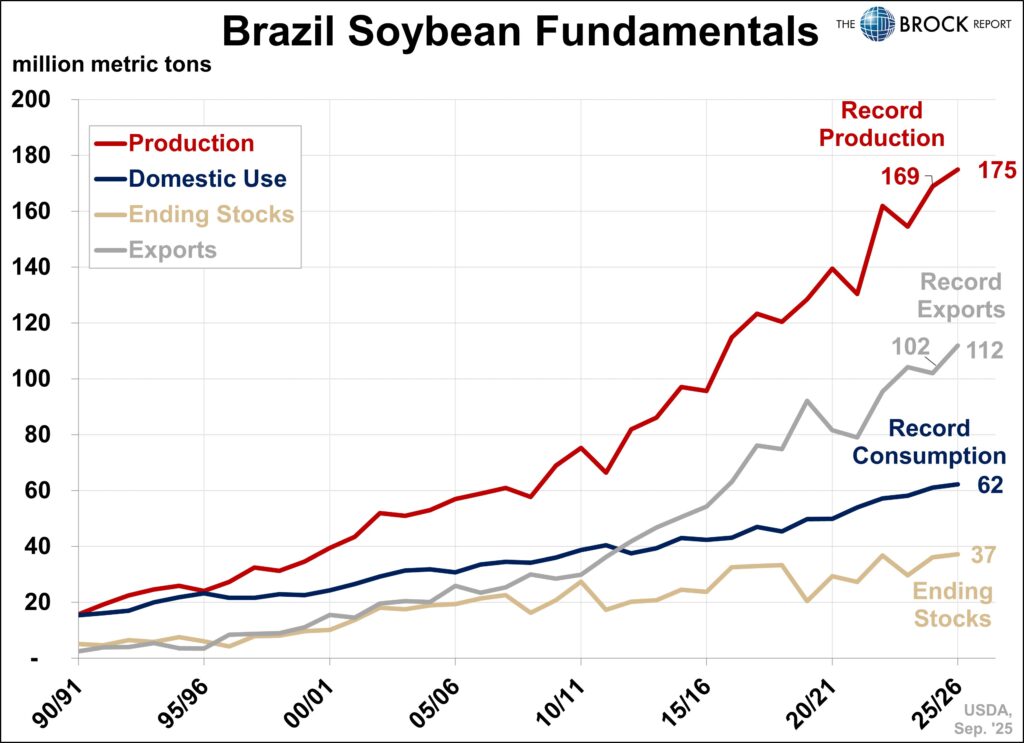

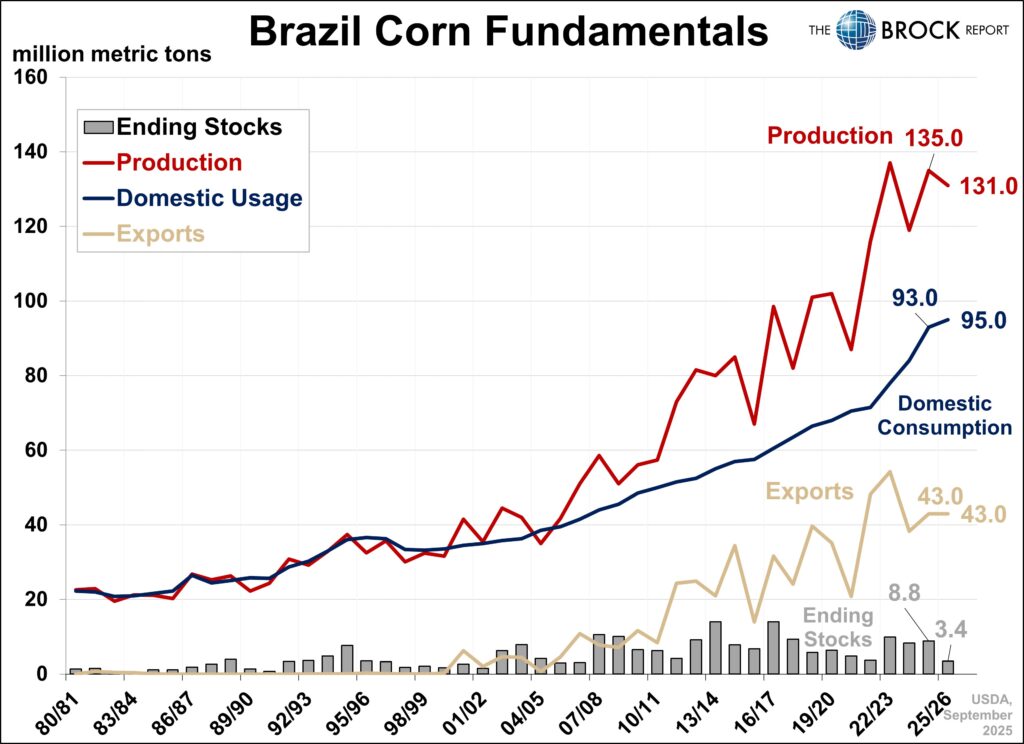

Note in the chart of Brazil corn fundamentals that in the last 20 years, Brazil has gone from producing under 40 million metric tons per year to this year’s estimated 131 million metric tons. During the same timeframe, Brazil has gone from producing 60 million metric tons of soybeans to 175 million metric tons.

Why? Many reasons. Some may say it is all political but that is not really the case. Twenty years ago, major seed genetic companies were all American and many countries in the world did not have access to U.S. seed technology. Now farmers around the world have access to high end seed technology.

The other factor that is not discussed often is the mere fact that Brazil still has large amounts of land to bring into production. We don’t have any, and total row crop area has actually been trending lower. Increased production in Mato Grosso, northern Brazil, has been dramatic and China has been helping build infrastructure to get corn and soybeans from that area in Brazil to export facilities over a thousand miles away. This is changing the world and there’s really very little we can do about it. It is very difficult to imagine how the U.S. is going to be able to stop losing more export share, much less recapture the export share in corn and soybeans that we have lost. The fundamentals and logistics favor South America. Domestic use of corn and soybeans in the United States is taking on more importance and thankfully this has been a bright spot. With low prices, history would indicate that new demand within our country’s boundaries will be generated.

From a U.S. balance sheet perspective, cash corn and cash soybeans are both underpriced. As we’ve mentioned several times since August, both markets have made a bottom. That does not necessarily mean they are going sharply higher but as we’ve said many times, the prices are done going down.

The recent events in China that are weather related, however, could be significant. Combine that with the fact that corn and soybean harvest is coming to an end in the United States and commercial companies are going to have to bid up to get grain off the farm now. Add to that the fact that some government payments will be going to farmers starting in less than a week (see page 10), the need for cash flow will not be very strong. Most producers will be able to hold out until the first of the year, and some much longer.

Basis levels have risen throughout most of the Midwest but from the mid-south and southeast, we anticipate basis levels will start to widen. The lack of rainfall in the central and southern part of the United States is having very negative effects on water levels in the lower Mississippi. Commercial companies are wanting grain to be brought in immediately in order to put on barges in the hopes it can make it through the Mississippi before the river dries up even more. There is a big premium now to deliver grain to Mississippi terminals within the next several days. This will have a trickle-down effect on interior bids as well. Thus, even with harvest drying up, any grain that is being moved by the Mississippi River is going to feel a negative impact.

Technically, corn and soybeans are looking positive. Corn, in particular, stopped at a very critical support area. Meanwhile, all indications are that corn and soybean yields are going to fall short of USDA’s lofty projections in its September crop report. Many Midwest producers are reporting their harvests are down from a year ago.

The bottom line is that we do not suggest being an aggressive seller in this kind of market. Between concerns about corn in China, uncertainty over dryness in Brazil, and some disappointing U.S. yields, no matter how you slice it, corn and soybean prices are going to be firming up. From a timing point of view, the next timeframe we are focused on is mid-December. That will be a time most likely to be making catch-up sales.